The post Reimagining legacy mine closures appeared first on Without Limits.

]]>Drawing on insights from a recent AECOM mine closure executive forum, Sneha Chanchani, our global energy and sustainability advisor, explores how mining companies can navigate this evolving landscape. She explores the value of shifting from a project approach to a program mindset, reframing mine closure as more than just an endpoint. Instead, it becomes a generational opportunity to create a positive legacy by regenerating land, building trust, and creating lasting value for both communities and mining companies.

Mine closure is hard, and getting harder

Mine closure is an inherently complex undertaking. Our proprietary analysis of more than 10 global mine sites shows closure timelines can span decades — often 30 years or more. These long timeframes are shaped less by mine size and more by environmental, social and regulatory intricacies. Even then, the goal of a “walkaway”, free from ongoing obligations, is often elusive. Only a few sites globally have received closure certificates acknowledging the site has been rehabilitated.

As operators take on this long-term responsibility, they are focused on site safety and sustainability, meeting community and regulatory expectations, and managing liabilities. Throughout this multi-generational process, technologies, regulations, best practices and stakeholder expectations will keep progressing, reshaping what responsible and effective closure looks like.

Navigating these challenges has never been easy, but it is becoming harder as expectations rise. Updated frameworks such as the International Council on Mining and Metals’ Integrated Mine Closure: Good Practice Guide (second edition) emphasize social, environmental and economic outcomes. Investors are increasingly entering the conversation, with the Global Investor Commission Mining 2030 calling for mines to leave a positive legacy. The Church of England Pensions Board is pushing for new tailings management standards, and using its financial influence to promote industry-wide compliance.

This pace of change is not likely to slow, so mine operators need an approach with the flexibility to manage closure through long durations and changing expectations. For newer sites, there’s an opportunity to embed closure planning from the outset to lay the foundation for more efficient, sustainable outcomes down the line.

A new approach: From projects to programs

Traditional major project management approaches can be effective for clearly defined infrastructure builds. But they have limits when it comes to the long timelines and shifting variables of mine closures. Project plans made at the start of the closure often struggle to accommodate changes over 30 years.

One effective solution is shifting from a project-based approach to a program management model. This means managing initiatives as part of a broader strategy — working holistically to deliver long-term outcomes through integrated planning, consistent delivery models and a focus on continuous improvement. A programmatic approach enables greater flexibility, measurable progress and cross-functional governance. It is dynamic, phased and responsive — equipping mining companies to navigate shifting risks and expectations, capitalize on emerging opportunities, and respond to evolving community needs, ultimately increasing the certainty of a successful closure.

A rigorous plan is still critical, of course. A successful program still begins with robust stakeholder engagement, leading to a shared vision of closure criteria, post-closure use and ongoing stewardship. Whether the goal is ecological restoration or redevelopment, this plan establishes a strong foundation and clear direction for everyone to work toward.

But the plan also embeds contingencies and continuous improvement into its DNA. Program-based closure incorporates ongoing reviews, even post-closure, to assess best practices in light of shifts in technology, climate, regulations, workforce and stakeholder expectations. It integrates lessons learned from other projects, ensuring the plan remains current, informed and resilient.

Program management promotes a fundamental mindset shift for those delivering it. Success depends on equipping managers with the tools and training to operate within a “plan, do, assess, learn” cycle — one that prioritizes learning over fixed delivery and encourages experimentation and innovation.

All of this supports early identification of issues and continually spots opportunities to improve. Take stakeholder engagement: ongoing dialogue helps teams stay aligned with evolving expectations throughout the closure process. Or technology: routine assessments allow mines to benefit from advances in areas like artificial intelligence, sensing and automation — tools that could dramatically reduce cost or improve outcomes.

This kind of adaptability helps prevent issues before they escalate. It enables mine closures to evolve with changing conditions, ultimately reducing closure durations, liabilities and costs.

Long-term value for mining companies and communities

A long-term program management mindset is a powerful tool to improve the closure process. But it also opens the door to lasting, value-generating outcomes through ongoing stewardship.

For instance, nature-based solutions like reforestation and wetland restoration can produce ‘habitat credits’ and ‘carbon credits’, which can be sold to offset environmental impacts elsewhere. Kennecott Utah Copper has restored 3,670 acres of saltpans and industrial land into shorebird habitat along Utah’s Great Salt Lake. A Utah Department of Natural Resources study suggests this project and others like it could generate tens to hundreds of thousands of dollars per acre in wetland credits to help offset ongoing monitoring costs.

Repurposing sites for renewable energy offers another opportunity. Chevron’s Questa Mine in New Mexico installed a one-megawatt solar facility on its tailings area, selling electricity to the local cooperative under a long-term contract.

These strategies enhance environmental outcomes and unlock new revenue streams. They also strengthen the social license to operate — closures that create community value can build trust with key stakeholders and reduce the risk of post-closure concerns arising.

Leaving a lasting legacy

Mine closure is more than a technical challenge or a regulatory requirement. It is a strategic opportunity to demonstrate value, build trust and leave a positive legacy.

By adopting a program management approach — flexible, responsive, and long-sighted — mine operators can deliver lasting outcomes that meet diverse needs, and shape a future where closure is not the end of the story, but a new beginning.

To learn more about legacy mine closures, reach out to our mining leads or contact your AECOM account manager directly.

The post Reimagining legacy mine closures appeared first on Without Limits.

]]>The post Aussie rules for offshore wind: Five must-know insights for developers appeared first on Without Limits.

]]>In reality, Australia presents a potentially frustrating mix of challenges: a vast grid that isn’t always ready for large-scale offshore wind integration, complex and misaligned federal and state approval pathways, high regulatory expectations but limited baseline data, and unpredictable community engagement dynamics. Developers who rely on what has worked elsewhere risk major delays and cost overruns.

As the approvals consultant for the nation’s most advanced offshore wind farm, Star of the South, we have been at the forefront of the local offshore wind industry since 2019. But our experience goes well beyond offshore. For more than a decade, we’ve delivered planning, design and engineering services across transmission and distribution networks for Australia’s major utility operators. From grid connection negotiations and network modelling to corridor planning and substation design, our integrated capability — and deep understanding of local standards and key stakeholders — means we can look at the bigger picture across the full development lifecycle.

This is further strengthened by team members with offshore wind experience from around the world, giving us a clear view of what ‘normal’ looks like for international developers, and where the Australian market differs. Based on this combined experience, here are five critical insights every offshore wind developer should know before entering the Australian market.

De-risking offshore wind projects in Australia

1. Disjointed connection frameworks increase integration risk

Australia’s grid connection process is more complex than many international developers expect. Australia’s National Electricity Rules and network planning requirements present real challenges; no clear framework for shared infrastructure, limited coordination across offshore projects and no dedicated provision for transmission corridors.

Through our involvement in more than 25 projects over the past five years, we’ve seen how early awareness of evolving grid regulations is critical. In one case, we resolved a mid-project clash between reactive power requirements and inverter capabilities through early technical engagement and negotiation.

Offshore components like turbines and inverters can also face approval hurdles if they’re not already recognised under Australian standards. We’ve supported clients through this process, helping to navigate model approval and working with industry groups to ease the path for new technology.

2. Australia’s grid network is fundamentally different

Australia’s grid is isolated, low-density, long, stringy and unmeshed. It’s difficult and time-consuming to connect. With a small population and state-based grids (for example, Western Australia’s standalone system), load sizes are smaller. In Victoria, the single biggest allowable loss of a generation connection is 600 megawatts. This often necessitates stability systems and batteries to secure a connection agreement and protect grid integrity.

3. The tyranny of distance is real

Australia’s remoteness poses major logistical challenges. Long shipping distances, limited local manufacturing and exposure to global supply chain disruptions all increase costs and lead times. Offshore components often require modifications, such as complete rewiring, to meet local standards. These are crucial considerations during development and contracting.

4. Offshore wind regulation is complex and fragmented

Australia may look familiar to international developers. Its transition policies often echo those of the UK and Europe, and regulators are generally open to adopting global best practice where local guidelines are still evolving.

But beneath the surface, things get complicated. Each state has its own environmental and planning approval pathways, often overlapping with Commonwealth requirements. For example, projects beyond three nautical miles fall under federal jurisdiction alone, but those closer to shore must meet both state and federal approvals. The same applies to species protection, with threatened or migratory species potentially governed at one or both levels.

Compounding the challenge is a lack of detailed ecological baseline data, particularly compared to Europe. This makes local expertise essential. We work with trusted partners, like JASCO Applied Sciences for underwater noise, BMT for marine ecology and Nature Advisory for bird impact assessments, as we’ve done for Ørsted’s Gippsland 1 Offshore Wind Farm.

New entrants should be prepared for a regulatory environment that’s still maturing. Interpreting requirements, not just following them, is often necessary, and online guidance quickly becomes outdated. Strong local relationships with regulators can make all the difference. Our long-standing engagement with key agencies ensures we stay ahead of change and help our clients do the same.

5. Poor community engagement threatens social license to operate

In Australia, renewable infrastructure can be polarising, especially offshore wind, which interacts directly with our treasured coastline. With 85 percent of the population living within 50 kilometres (31 miles) of the coast, many communities are deeply connected to recreational activities like surfing, fishing and camping, and wary of anything that might disrupt that way of life.

Projects that fail to engage early and meaningfully with local communities risk being derailed by public opposition. But reactions vary widely. The Gippsland community, for instance, continues to show strong support for offshore wind, thanks to the groundwork laid by Star of the South. Community support for this came from listening to what mattered most; for Gippsland, it was recreational fishing, and taking steps to minimise impacts, such as protecting nearshore fish populations and limiting exclusion zones during construction.

Engagement goes beyond consultation. Communities respond positively when they see real local benefits: job opportunities, supply chain involvement and housing solutions that prevent rent hikes. In the EU or UK, housing construction workers who are flown in to work on an offshore wind project might be a challenge, but here in Australia, amid a rental crisis in low-populated regions, it could become a deal-breaker. Some developers are addressing this by recruiting local workers and facilitating accommodation that can later be converted for other uses, meeting short-term needs and leaving a positive legacy.

A safe pair of hands in offshore wind

Success in Australia depends on local knowledge, relationships and credibility, across both engineering and environmental disciplines. We bring deep local experience, global offshore wind capability and trusted partnerships with local experts and stakeholders.

We help developers interpret complex regulations, navigate approval processes and build meaningful community engagement strategies. With our finger on the pulse of regulatory change, we know how to de-risk offshore wind development in Australia, from concept to construction, by playing by Aussie rules.

The post Aussie rules for offshore wind: Five must-know insights for developers appeared first on Without Limits.

]]>The post Overwhelmed by mandatory climate reporting? Four questions to get you started appeared first on Without Limits.

]]>It’s a fast transition, and organisations face a complex set of new reporting requirements. While compliance is now a key driver, the challenge lies in defining risk ownership and governance, assessing climate risks and opportunities across your value chain, quantifying financial impacts, and integrating these insights into decision-making.

AECOM specialises in the detailed technical work that underpins credible climate disclosures. Our expertise spans risk assessments, scenario analysis, adaptation planning, and financial impact quantification – ensuring organisations can provide meaningful and defensible disclosures.

Our four key questions will help you navigate these requirements while strengthening your organisation’s ability to manage climate risks effectively.

Through initiatives like Climate Risk Ready NSW, we have helped organisations establish a structured and consistent approach to climate risk assessment. This groundwork gives decision-makers confidence in their climate risk disclosures and supports proactive resilience planning.

By investing in this foundational work now, your organisation can meet compliance obligations while building long-term resilience. Let’s get started.

Changes to climate-related reporting

New legislation in Australia and New Zealand is mandating large organisations to measure and report on climate-related disclosures, forcing organisations to take immediate action. New Zealand implemented mandatory disclosures through the Financial Sector (Climate-related Disclosures and Other Matters) Amendment Act 2021. Disclosure requirements have been effective from 2023.

In Australia, reporting requirements were introduced via the Treasury Laws Amendment (Financial Market Infrastructure and Other Measures) Act 2024 (Cth) and have been effective since January 1, 2025.

What can we learn from New Zealand?

Two years ahead of Australia, there are lessons to be learned. The Financial Markets Authority conducted a review of 70 statements after New Zealand’s first year of mandatory reporting. The main areas for improvement were; fairer presentation of data, clearer explanation of process, and a need for organisations to find the right balance between too much and too little information.

How should you prepare for mandatory climate reporting? Four questions to get you started.

1. What are your risks and opportunities?

Start by evaluating how climate change might impact your operations, supply chains, markets, and strategic planning. Consider physical risks from extreme weather, and risks and opportunities from policy changes, technological advancements, and market shifts. Develop adaptation and transition plans outlining priority issues, necessary responses, and a governance framework.

Identify and quantify climate-related risks and opportunities. Disclose the metrics used to monitor these risks and responses. Collaborate with financial, operations, and risk experts to measure and disclose financial impacts. Use existing metrics to measure disruption, asset degradation, stoppages, and supply chain delays. Connect climate-related risks to adverse outcomes that these indicators can measure.

2. Tools are useful, but what is your risk-based approach and how will you engage stakeholders?

Understanding climate-related risks and opportunities requires more than just tools; it demands a risk-based approach and active stakeholder engagement. Tools can provide comprehensive analysis and transparency about the process and data gathered, helping to build internal capability and understanding of your organisation’s climate risk profile.

While mandatory reporting might be new, the skills needed to respond effectively aren’t. Our 18+ years working in the field tells us that engaging in collaborative conversations and workshops allows stakeholders to exchange experiences and knowledge more effectively, making the assessment more representative. Integrating engineering specialists into the process ensures that risks and adaptation solutions are practical, balancing physical and material costs with risk appetite.

3. How will you integrate risks into strategy and risk management for long-term resilience?

Long-term resilience needs to integrate climate risks into strategy and risk management processes. We’ve worked with organisations like the Department of Defence, Sydney Water, Stockland, and major Australian airports, which often have two key documents: one for long-term strategy and another for risk management. These frameworks guide daily operations while addressing future challenges.

Embedding climate impacts into these systems ensures effective responses to immediate and long-term challenges. We collaborate with clients to assess needs and readiness, using robust tools to identify priority risks, communicate insights to governance bodies and communities, manage risks, and report on them, fostering resilience at every step.

4. How will you monitor and measure risk and progress?

Continual review of climate-related risks and adaptation actions has always formed part of assessment standards, but mandatory climate disclosures demand greater rigour in monitoring and measuring climate impacts. Clear links are needed between risks or opportunities, outcomes, impact measures, and targets. Your organisation must track the likelihood of risks or opportunities, and the progress of adaptation measures to minimalise or capitalise on these. Significant resources may be required, but leveraging existing metrics and internal systems can improve efficiency.

We’ve developed guidelines for various organisations across sectors including the Climate Risk Ready NSW Guide and the Climate Change and Natural Hazards Risk Assessment and Adaptation Planning Guidelines.

So what’s next for mandatory climate reporting?

It’s clear organisations have significant work ahead to prepare for comprehensive reporting. Developing a robust program of work that also builds internal capabilities is essential. Remember, reporting is not the end game; it’s communication tool, assuring stakeholders that your organisation is aware, prepared, and responsive to change.

We take a collaborative approach to understanding our clients’ assessment and reporting needs to integrate resilience into their work. We apply robust tools to identify and manage priority risks and support clients in communicating insights to governance bodies and the community.

No matter where you are on your climate risk journey, please reach out to our Sustainability & Resilience Practice to help you advance further.

Supporting Brisbane Airport’s climate resilience journey

For nearly three years, AECOM has collaborated with Brisbane Airport Corporation (BAC) on climate change projects, starting with a risk assessment and adaptation plan, followed by a vulnerability assessment, executive training on climate disclosures, and a gap analysis against mandatory reporting standards. Each project builds on and applies previous findings and lessons, ensuring tailored recommendations for BAC’s context and operations. Stakeholder involvement has expanded from BAC’s Sustainability team to include finance, policy, strategy, risk, asset management, and aviation operations. This broader internal stakeholder participation has deepened BAC’s understanding of climate change, embedding it further into their planning and operations.

The post Overwhelmed by mandatory climate reporting? Four questions to get you started appeared first on Without Limits.

]]>The post Piloting LEAP: Assessing infrastructure’s nature-related dependencies and impacts appeared first on Without Limits.

]]>Many businesses and organizations are now becoming more aware of their impact on nature and how this may affect operations and financial performance. Understanding the relationship between nature and business, and risks and opportunities this presents, will guide corporations, leaders and investors in making decisions where conservation and business performance are prioritized.

A way to assess infrastructure’s relationship with nature

The Taskforce on Nature-related Financial Disclosures (TNFD) was established to help organizations and businesses better assess their relationship with nature. This framework, which was released towards the end of 2023 and examined by us previously, provides a consistent approach for organizations to assess, report and act on their dependencies and impacts a on nature.

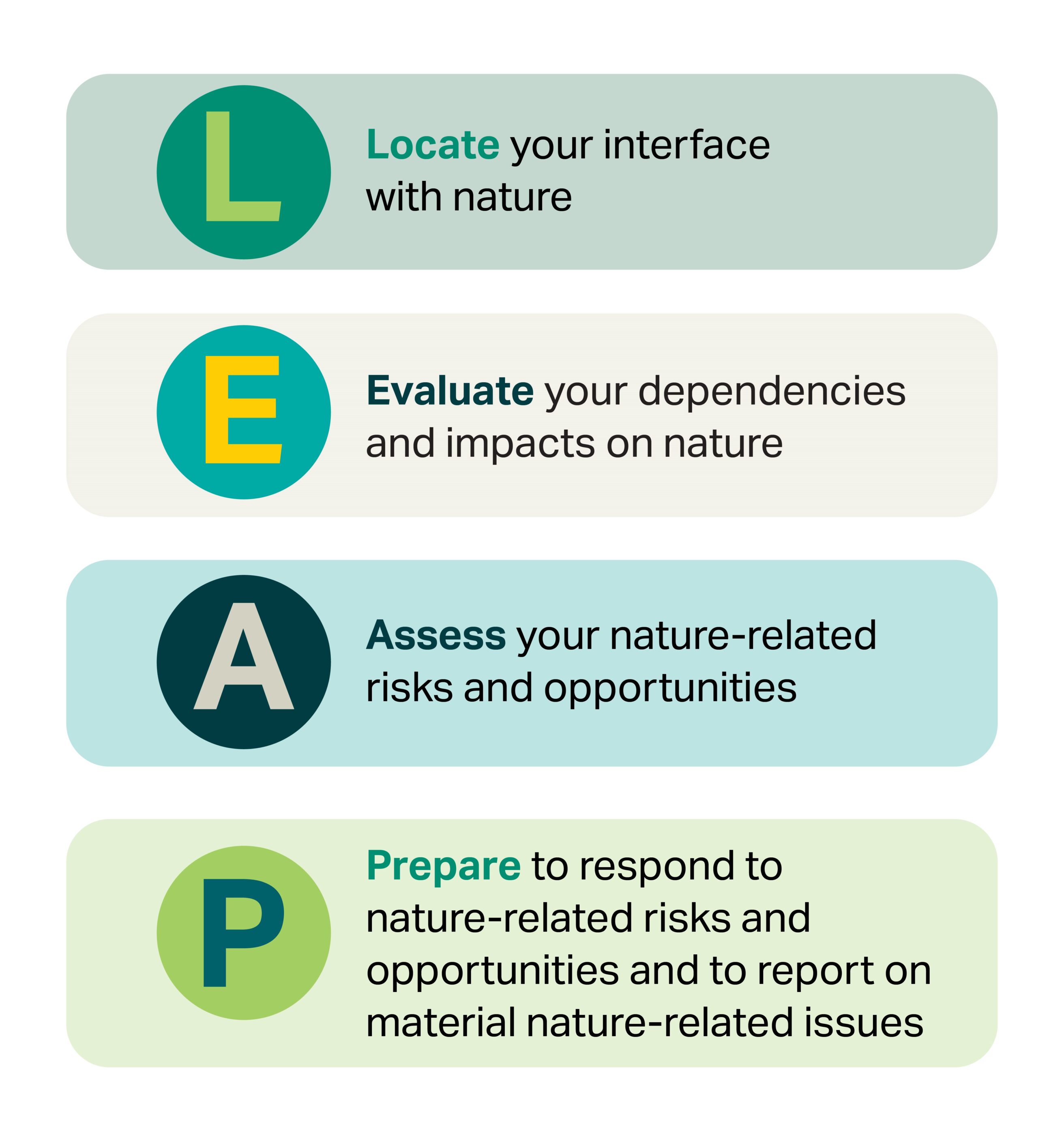

AECOM took part in Global Canopy’s TNFD piloting program prior to the launch of the TNFD’s Final Recommendations in September 2023. Supported by Global Canopy and Nature-Based Insights (NbI), we piloted the TNFD’s LEAP (Locate, Evaluate, Assess, Prepare) approach to identify and assess our nature-related issues and explore how our infrastructure projects can better account for nature-related risks and dependencies. The pilot involved a high-level assessment for a portfolio of projects across Asia. These included urban developments, shoreline restoration, power transmission lines, and cross-border rail connections, which are in contact with a range of biomes such as tropical and subtropical moist broadleaf forests, tropical and subtropical dry broadleaf forests, savannah and shrublands, inland wetlands and mangroves.

Unlike traditional environmental assessments, which often focus on immediate, site-specific impacts, the LEAP approach takes a broader view. Across four phases, it considers the landscape as a whole, looking at factors like biodiversity, water stress and physical risks such as flooding or drought.

Putting the LEAP approach into practice

Our pilot study evaluated 87 projects in Asia based on nature variables or datasets grouped under eight categories — biodiversity importance, ecological integrity, ecosystem extent, ecosystem change, physical risk, water stress, reputational risk, and dependencies and impacts on nature. Our technical partner, NbI, developed a scoring system that allowed us to compare projects and identify the extent of their nature-related dependencies, impacts, risks and opportunities. For example, projects in areas with high water stress were flagged for their reliance on scarce water resources. On the other hand, infrastructure builds may be less dependent on water but may amplify environmental challenges — such as water depletion or habitat loss — while also being vulnerable to external risks like flooding or coastal erosion.

Identifying and analyzing complex variables necessitated the use of digital tools and data sets. We used Aqueduct to identify water risks and project vulnerabilities to water and the Integrated Biodiversity Assessment Tool (IBAT) to evaluate biodiversity importance and ecological integrity. These tools where helpful in scoring projects under the eight categories based on the available nature variables and datasets. We then used ENCORE, a free, online tool that helps organizations explore their exposure to nature-related risk and take the first steps to understand their dependencies and impacts on nature, to map our supply chain activities and see the potential impacts and dependencies on nature from materials used and upstream production processes. These gave us a wider understanding of what ecosystem services and natural capital assets we’re most vulnerable to, and how we can mitigate this. It also provided an opportunity to discuss with our supply chain partners potential solutions to reduce their nature-related impacts and risks.

A new chapter for environmental assessments

One of the broader implications of this study is that it demonstrates how the TNFD framework could enhance traditional Environmental Impact Assessments (EIAs). Typically, an EIA is undertaken once a site is already selected and usually assesses the environment at a granular level, and very rarely looks at landscape scale issues in a holistic way. At the same time, EIAs tend to stay at the operational level, whereas LEAP brings nature-related issues to the strategic and governance level of an organization. Understanding dependencies and impacts with a bird’s-eye view could benefit organizations in the long run, allowing them to potentially see and avoid costly mistakes and hurdles that may appear at a later stage.

By incorporating a wider range of nature-related considerations, EIAs can evolve to address emerging challenges like biodiversity loss and water scarcity more effectively. This approach doesn’t just mitigate risks — it creates opportunities for positive outcomes, such as biodiversity net gain or improved ecosystem services.

For example, a project near an area with a high presence of invasive species may spread and exacerbate the problem. However, it may also present an opportunity to reintroduce native species and aid nature recovery.

The framework will also prove useful in developing some of our current projects, particularly those in the design stage, such as our work in the Northern Metropolis in Hong Kong, where we are balancing development needs with nature conservation through a people first and nature positive approach.

Enhancing nature-positive infrastructure planning

Applying elements of the TNFD LEAP process allowed us to see the wider nature-related risks of our projects and the construction sector’s critical dependencies on nature. It also presented opportunities to consider incorporating green and blue infrastructure and nature-based solutions at a project design.

The pilot study identified that providing this project level nature-related risks and dependencies analysis at the ‘alternatives evaluation’ phases of infrastructure investment planning may also improve decision-making at the siting and design stages of projects, which in turn will reduce cost and nature risk at the infrastructure design stage.

Additionally, collaboration with supply chain partners on reducing the impacts of their operations on nature will help shift the whole sector towards meeting globally biodiversity and climate goals.

The pilot study gave us valuable insights on TNFD’s LEAP approach and its potential to shape how EIAs are conducted in the future. If adopted and executed properly, it could create a ripple effect in the industry and its supply chain, encouraging a more holistic approach to nature assessments and nature-positive development.

Read the full case study on our pilot. For more insights, visit the Global Canopy and Nature-Based Insights . Global Canopy is a founding partner of the TNFD, and was an official piloting partner for the TNFD prior to the launch of the TNFD Final Recommendations in September 2023. It continues to provide technical expertise to the TNFD, and to build capacity among companies and financial institutions, preparing them to get started with adopting the TNFD recommendations.

The post Piloting LEAP: Assessing infrastructure’s nature-related dependencies and impacts appeared first on Without Limits.

]]>The post The Natural Capital Manifesto – Establishing a business case for nature appeared first on Without Limits.

]]>Our planet faces interconnected crises compounding into the climate and nature emergency. The degradation of ecosystems and loss of biodiversity can potentially destabilize the global economy.

Despite international agreements and targets, many countries still struggle to meet their goals and arrest declines in biodiversity. This shortfall is largely due to insufficient resources and a lack of effective policy and economic drivers. By aligning economic incentives with environmental sustainability, we can drive meaningful change and protect our natural resources.

To move forward from using carbon as a single environmental benchmark, and foster sustainable economies around nature, we need a strategic entry point that leverages the growing momentum in Environmental, Social, and Governance (ESG) ambitions among corporations.

We believe that the critical issue is recognizing the value of nature and its natural capital. Traditionally, investments in conservation have been viewed as charitable endeavours, lacking explicit returns or gains for companies. However, to bridge the gap between the natural environment and the commercial world, we need a common ground. This is where data monitoring and the quantification of natural capital can play crucial roles, creating synergy by demonstrating the tangible benefits and returns of conservation efforts.

We aim to establish frameworks that recognize and capitalize the value of natural ecosystems, thereby integrating natural capital with traditional financial systems and fostering economies that are aligned with nature. The Natural Capital Manifesto discusses methodologies for measuring conservation impact, showcase case studies, and outline pathways for integrating these insights into mainstream investment practices.

The method: three steps towards nature investments

The Natural Capital Manifesto outlines three steps that merges conservation, digital and AI technologies, and financial incentives to restore ecosystems. These steps involve:

- Creating a high-performance ecosystem – Conserving the last remaining high-performing ecosystems is not enough to overturn the nature and climate emergency. Our focus is therefore to restore ecosystems. This involves applying scientific principles to improve ecosystem performance, ensuring that all restoration actions are grounded in robust research and evidence.

- Natural capital quantification – To quantify the results of restoration and enhancement actions, natural capital accounting will be employed, using five selected performance data points as key performance indicators. Natural capital is defined by a basket of metrics relating to air, water, soil, carbon, and biodiversity.

- Digital monitoring and display – The monitoring process involves establishing a robust and comprehensive data monitoring system using camera traps, audio recordings, and eDNA. This approach ensures thorough and accurate data collection. The data will then be displayed in a natural capital digital twin with a user-friendly interface, making the information accessible and understandable to all stakeholders, including the public.

Moving towards a balanced future

By integrating natural capital investments in their overall strategy, businesses can create a continuous cycle that benefits both natural and financial capital. Investments in green technologies, sustainable practices and conservation efforts can enhance ESG performance, strengthen brand value and improve business sustainability. With today’s nature emergency calling for urgent action, proactive engagement in conservation is essential in business continuity plans and should be an integral part of strategy to help sustain operations and thrive in the future.

Read the Natural Capital Manifesto here

The post The Natural Capital Manifesto – Establishing a business case for nature appeared first on Without Limits.

]]>The post High-performance ecosystems: The cornerstone of nature positive urban spaces appeared first on Without Limits.

]]>The climate crisis and biodiversity loss are the two biggest global threats today. At COP15 in 2022, it was estimated that nature conservation would require annual funding of US$200 billion, with 196 nations committing to conserve 30% of the earth’s oceans, lands and freshwater ecosystems by 2030. Less than two years later, COP16 concluded that we are far short of the required funding levels to halt biodiversity declines, and new financial mechanisms are failing to gain traction. This reality check underscores the urgent need to intensify our efforts to protect and restore our ecosystems.

Balancing development and conservation through high-performance ecosystems

In the Natural Capital Manifesto, AECOM outlined innovative strategies to create a new asset class centered around nature, focusing on quantifying and rewarding investments in conservation initiatives. This approach integrates natural capital with traditional financial systems, fostering economies that benefit both people and the environment. It begins with the creation of high-performance ecosystems.

A high-performance ecosystem is any nature-based solution or ecosystem-based approach that is planned, designed and managed to optimize ecosystem service delivery. By enabling high-performance, we can amplify the environmental benefits of all projects, applicable to both infrastructure systems in urban centres and natural habitats in the hinterlands.

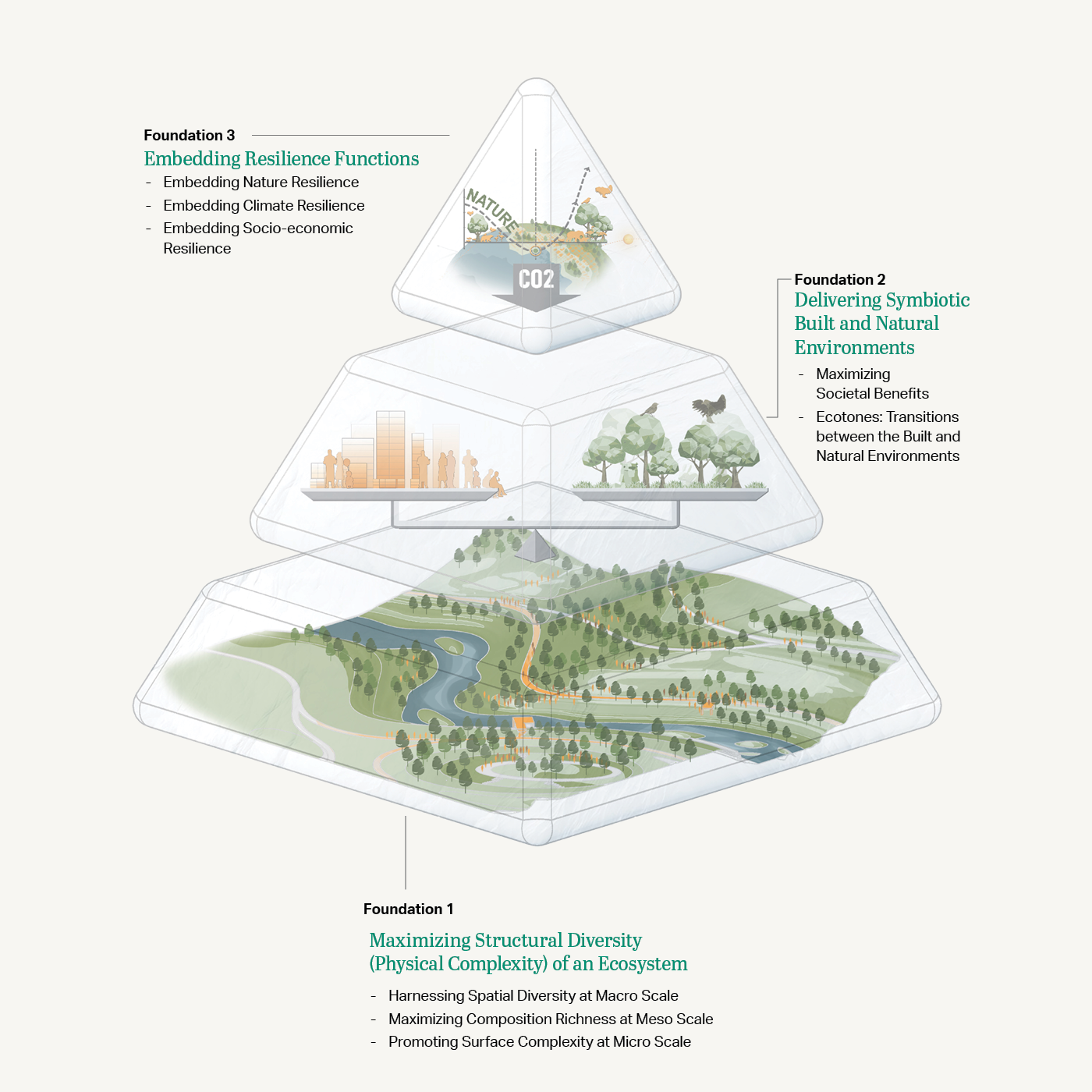

Drawing on best practices from AECOM’s multi-disciplinary experts, the Design Principles for High-performance Ecosystems is a comprehensive framework. It guides the design and management of ecosystems to deliver maximum environmental benefits. The framework features eight principles, anchored on three foundations:

Physical complexity supports higher biodiversity

Compositional richness in nature’s building blocks, whether natural or man-made, plays a crucial role in shaping diverse and functional ecosystems. Physically complex habitats, with varied structures and layers, tend to support higher biodiversity by offering a greater variety of niches and microhabitats that support different species. For instance, in forest landscapes, structural diversity is largely provided by the trees and plants. Varying tree densities, age classes, and species compositions enhance the complexity of forest ecosystems, creating niches for different organisms to thrive.

The same approaches used in natural habitats can also be applied in urban settings by maximizing compositional diversity through integrating various habitat elements and native plants. In urban parks, for example, diversity can be promoted by using plant species that flower and fruit throughout the year, supporting local wildlife. Incorporating pollinator-friendly plant species enhances biodiversity, supports essential ecosystem services, and helps maintain healthy urban ecosystems.

Integrating nature-inspired features into urban design

Nature-inspired landscape features can also enhance urban biodiversity. For instance, gabion walls made from wire cages filled with rocks provide structural support and create habitats for insects, amphibians, reptiles, and plants. The eco-shoreline, such as the one adopted by AECOM at Tung Chung East in Hong Kong, is a nature-based solution that enhances surface complexity in intertidal zones. By providing different niches that respond to physical stresses (e.g. heat and desiccation) and biological stresses (e.g. competition and predation), biodiversity is enhanced, from algae to invertebrates to fish. Elsewhere, concrete printing has been used to mimic the micro scale complexity of sub-tidal reefs.

At a global scale, creating landscapes that promote biodiversity brings us closer to nature positivity. Larger areas of high-quality habitats enhance nature’s resilience to climate-related changes and human disturbances, helping to secure the viability of threatened species and habitats. At the project level, key measures to consider in designing resilient ecosystems include using species tolerant of future temperature variations and incorporating those capable of withstanding flood and drought conditions.

High-performance ecosystems: prioritizing people and planet

While development and conservation are often seen as opposing forces, this need not be the case. From the expansive macro scale to the intricate micro scale—such as the concrete textures applied in the eco-shoreline—embracing complexity can deliver inspiring and sustainable solutions that enhance the quality of life for both people and our planet.

Despite international efforts, progress on financing nature-positive initiatives remains uncertain. This uncertainty presents an opportunity for the private sector, governments, and organizations to step in and leverage green finance to develop ambitious nature-based solutions. Creating high-performance ecosystems is a crucial first step in building a common ground between conservation actions and the commercial world.

To read the full publication on AECOM’s Design Principles for High Performance Ecosystems, click here.

The post High-performance ecosystems: The cornerstone of nature positive urban spaces appeared first on Without Limits.

]]>The post Building for the future: integrating social value appeared first on Without Limits.

]]>Infrastructure is often key to getting economies back on their feet. In selecting projects, though, decision makers should not lose sight of social objectives. Social benefits are typically quantified through the number of jobs created, start-up industries spawned or increases in productivity. Social value, on the other hand, is defined as a broader understanding of value. It moves beyond using money as the main indicator of value, instead focusing on how a project impacts the lives of people.

Taking an equitable approach

Our industry can play an advocacy role by focusing attention on projects that incorporate social values thinking — from the design and planning stages through to delivery. Social equity is essential in helping disadvantaged individuals improve their lives. It is no good providing benefits to those who already are privileged and leaving underprivileged communities behind.

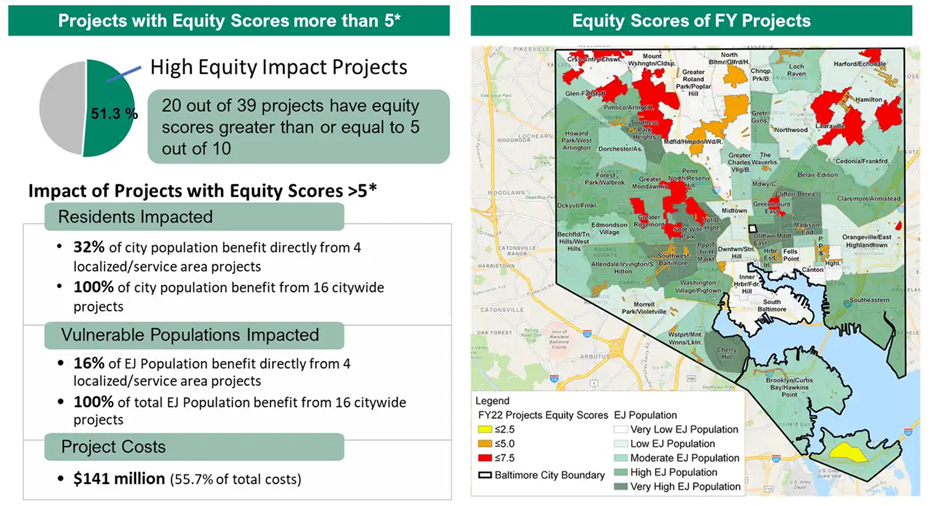

Getting good data is critical to generate the right social outcomes. We have developed the Equity-based Capital Planning Tool, a project tool that incorporates social, environmental, economic, and operational criteria. This tool also uses a data-driven methodology to capture spatial and demographic context for infrastructure projects, ensuring disadvantaged communities can co-benefit from investment.

Case study: Baltimore Department of Public Works, Maryland, United States

To illustrate how our Equity-based Capital Planning Tool is used in practice, we are supporting the Baltimore Department of Public Works in determining which projects should move forward. Our framework and web-based tool evaluates public projects based on a comprehensive quadruple-bottom-line “equity lens” that examines structural, distributional, procedural, and transgenerational dimensions of equity to provide a standardized way to select and bundle projects for the Department of Public Works Capital Investment Plan.

At project initiation, the tool calculates the statistics within the project area and displays aggregated data such as percentages of disadvantaged and/or minority populations within the project area. This enables the City to evaluate multiple locations. Each potential infrastructure project receives a scorecard for project performance, equity (including alignment within the Federal Government’s Justice40 Initiative) and combined performance and equity to help the City prioritize and make equitable infrastructure investment choices. Outcomes of the project include improved visibility and impact of equity in decision-making, more comprehensive equity considerations and enhanced equity analysis and insights.

Gaining buy-in from stakeholders

Stakeholder engagement is crucial to creating social value and this input needs to be incorporated in designs to achieve positive social outcomes. Our proprietary software, PlanEngage, facilitates two-way stakeholder engagement by visualizing what planned infrastructure will look like, how it relates to its environment, and how effectively stakeholders’ needs are addressed.

By using real-time visualization, designs can be clearly communicated from walkthroughs to virtual simulations providing immersive experiences, rather than simply confronting stakeholders with a proposal. Stakeholders can interact with designs, thereby enabling co-creation that reduces the risk of rejection and rework, and which helps to lower costs and maintain schedules.

We all have a role to play

To ensure infrastructure projects truly benefit society as a whole – and not just a select few – it is important to consider the following:

- There is a need to rethink infrastructure from a social value perspective. Meeting society’s needs is not just about physical needs, there are mental and emotional aspirations that can be uplifted with the right infrastructure design.

- Infrastructure should be designed with the well-being of users in mind. There are economic savings as well as social value benefits through well-designed and economically structured infrastructure that meets specific user needs.

- The responsibility for change lies not just in the hands of a few, but among many whose roles are to respect the rights of all and to help when needed. Infrastructure should take social justice and equity into account so that social value is evenly distributed.

The post Building for the future: integrating social value appeared first on Without Limits.

]]>The post The circular economy: a path to resilience and regeneration appeared first on Without Limits.

]]>The linear economy model of “take, make, dispose” has led to a massive increase in waste production. It is unsustainable and is worsening global problems of resource scarcity, environmental damage, and climate change.

The idea of a circular economy has emerged as a promising solution, as it aims to reduce waste generation and increase resource efficiency. In a circular economy, materials are retained in use at their highest value for as long as possible, and then never treated as waste, but as a valuable material for other uses.

The concept is inspired by natural ecosystems, where the outputs of one process become the inputs of another; and it challenges us to view “waste” as a design flaw to be designed out of a system, instead of an inevitable occurrence. The World Resources Institute has estimated that half of global carbon emissions come from the extraction and processing of materials, which could therefore be addressed using circular economy approaches.

The circular economy builds on the framework of the familiar “waste hierarchy” of reduce, reuse and recycle, but goes beyond this in its emphasis on retaining the value of resources. Central to the circular economy are three guiding principles: the elimination of waste and pollution, the prolongation of product and material lifecycles, and the regeneration of natural ecosystems.

By addressing key environmental challenges such as carbon emissions, pollution, and resource preservation, the circular economy presents a holistic solution.

Circular economy in Southeast Asia

For countries in Southeast Asia – where economic growth is rapid, population density is high, and environmental vulnerabilities are acute – embracing circular economy principles offers a path to resilience and regeneration.

In October 2021, the Association of Southeast Asian Nations (ASEAN) adopted the Framework for Circular Economy for the ASEAN Economic Community, which sets out an ambitious long-term vision for the circular economy, building on the strengths of existing ASEAN initiatives. It also identifies priority areas for action, to accelerate the realization of a circular economy in SEA.

In the first phase of implementation, the region is focusing on a number of broad initiatives such as developing circular economy standards for production processes and products, and improving access to sustainable finance to support circular initiatives.

Overcoming challenges in implementation

However, implementing circular economy initiatives is not without its challenges. There is still some uncertainty about how best to define and measure circularity – simple metrics like the amount of waste recycled can be used as a starting point, but do not capture the full range of benefits. Reusing and remanufacturing products and components is usually very environmentally beneficial, but there may be issues around quality control, warranties, and matching supply and demand both within an organization and with external parties. Economics can also be a barrier, with repair and refurbishment being labor-intensive and hence costly, compared to factory-made new products.

In addition, companies are still reluctant to make the transition to circular economy practices based upon a perceived lack of expected returns. Additional obstacles include a reliance on resource-intensive infrastructure, political obstacles, putting an appropriate price on resource use, high upfront costs, complex international supply chains, lack of consumer enthusiasm, and fostering inter-company cooperation.

Despite these challenges, organizations are adapting by rethinking processes to minimize waste and strategizing to deliver services with fewer material resources. Combining circularity principles with life cycle assessment can be a powerful tool to understanding, challenging and quantifying the impacts of a process. The newly-released ISO 59000 series of standards for the circular economy are expected to catalyze this process and also provide clarity over how to measure and assess performance.

Economic downturns have sparked increased interest in circular economies and green manufacturing, with government policies crucial in accelerating innovation. According to the Ellen MacArthur Foundation, the most profitable opportunities lie in products with a medium lifespan, allowing for reuse and remanufacturing.

Helping organizations implement circular economy as part of our Sustainable Legacies

As part of our Sustainable Legacies commitment, we provide ESG services, including all aspects of the circular economy, and work with companies across a range of sectors from pharmaceuticals, energy and transport to infrastructure and buildings.

The London example

For example, we have collaborated with the Greater London Authority (GLA) to develop guidance for implementing circularity in the built environment, aligning with the Mayor of London’s vision for innovative and circular design in the city’s homes, buildings, and infrastructure.

Policy SI7 of the London Plan mandates referable development proposals to include a Circular Economy Statement and aim for net zero-waste outcomes. We facilitated this process by creating the GLA Case Officer Toolkit, enabling case officers to evaluate planning applications based on circular economy principles, waste management, and resource efficiency across all development phases.

The toolkit establishes minimum standards, such as compliance with BS 5906:2005 and GLA/local authority guidelines, alongside recommended steps, like achieving zero biodegradable/recyclable waste to landfill by 2026. A report by the Mayor of London found that applicants for major developments were providing commitments to policy targets; reducing materials and waste associated with their development proposals, and exploring how waste could be managed more sustainably.

Building on this foundation, we continue to collaborate with architectural and engineering teams to deliver circular outcomes for numerous developments in London.

Conclusion

In transitioning to a circular economy, organizations must put increased emphasis on whole-life considerations and not just construction waste generation, with designs to optimize re-use, recovery, disassembly and adaptability of materials.

Additionally, nations and regions should proactively enact comprehensive frameworks and policies to accelerate circular economy efforts. By integrating circularity into legislation and promoting incentives for sustainable practices, we can create an environment conducive to innovation and investment in circular solutions.

References:

ASEAN. (2022). ASEAN for Business Monthly Bulletin October 2022. Retrieved from https://www.asean.org/wp-content/uploads/2022/11/ASEAN-for-Business-October-2022.pdf

ASEAN Secretariat. (2021). Framework for Circular Economy for the ASEAN Economic Community. Retrieved from https://asean.org/wp-content/uploads/2021/10/Brochure-Circular-Economy-Final.pdf

Kaza, S., Yao, L. C., Bhada-Tata, P., & Van Woerden, F. (2018). What a Waste 2.0: A Global Snapshot of Solid Waste Management to 2050. World Bank. Retrieved from http://hdl.handle.net/10986/30317

ISO. (2024). Circular economy — Vocabulary, principles and guidance for implementation. Retrieved from ISO 59004:2024 – Circular economy — Vocabulary, principles and guidance for implementation

MAYOR OF LONDON. (2024). Greater London Authority: Circular Economy Monitoring 2022. Retrieved from Greater London Authority: Circular Economy Monitoring 2022

The post The circular economy: a path to resilience and regeneration appeared first on Without Limits.

]]>The post The role of carbon markets in a credible approach towards net zero appeared first on Without Limits.

]]>The post The role of carbon markets in a credible approach towards net zero appeared first on Without Limits.

]]>The post Climate adaptation: principles to navigate uncertainty appeared first on Without Limits.

]]>The complexity, scale, and substantial costs associated with climate adaptation efforts have sparked lively discussion, particularly on the role of businesses in adapting to climate change. 2024 will mark the first time private organisations will submit their first adaptation action reports for the financial year to Aotearoa New Zealand’s External Reporting Board (XRB) Standards. Local authorities are now putting their heads together with business leaders on how best to approach the uncertainty of climate change. With local governments and many organisations developing these plans, there are concerns that the resulting climate projections may lead to over-engineered, expensive solutions that may lead to increased costs for consumers through rates and tax hikes and more expensive products and services.

Navigating uncertainty

In Auckland, there has been much discussion about Auckland Council’s decision to incorporate a worst-case climate scenario as a “baseline” for their stormwater code. This approach is perfectly understandable, given the impact of recent flooding and climate change in New Zealand. The scenario will include widespread climate risks, including increased floods, storminess, bushfires, inundation of coastal areas, and higher winds that damage infrastructure, but will not include specific climate mitigation targets that limit greenhouse gas emissions from fossil fuel use.

Local authorities now join proactive business leaders in exploring how best to embrace, understand, and navigate the uncertainty of climate change. For the infrastructure and engineering sectors, it’s easy to understand the desire to have a single standard for engineering and design, like the Auckland Stormwater Code. Like most modern business sectors, we want to minimise uncertainty. However, uncertainty in climate projections will not be rapidly resolved, and in the meantime, adaptation choices must be managed with a thoughtful and practical approach.

AECOM has delivered climate-resilience projects across Australia and New Zealand. Here, we share key considerations to understand better the risks and opportunities presented by climate change scenario planning.

Global vs local

The worst-case scenarios provide multiple global averages for temperature change for consideration. Local knowledge and context must be applied to understand the most suitable adaptation response.

Timing alignment

In terms of climate projections, there is limited divergence between the scenarios before the mid-century. After 2050, the differences in the scenarios become more marked, so selection should be based on asset life and business decision making.

Criticality of services

A risk-based approach is a common way to help manage the uncertainty between scenarios. Applying higher standards to assets or locations of higher criticality to reflect the risk tolerance of those assets being disrupted helps prioritise investment decisions.

Adaptability and flexibility

Avoid locking in a decision that leads to an inflexible pathway. If you adopt a scenario today that later is determined to have underplayed impacts, it becomes more expensive to undo that decision. Considering adaptability and flexibility may highlight more cost-effective adaptation responses by reducing over-engineering. However, we must resist the temptation to rush to replace or update assets ‘like for like’ and consider what the ‘like for right’ option is that offers a similar service given a change in climate. In some cases, a ‘like for like’ approach may be the costlier over-engineered solution.

Stress testing

To provide a balanced response, sensitivity testing should be undertaken, especially for periods after 2050. Stress testing requires considering two or more scenarios because these are climate projections, not near-term forecasts. Regulatory standards like the NZ XRB standards and voluntary methods such as those recommended by the Task Force on Climate-related Financial Disclosures require users to consider their resilience against more than one climate scenario. Skilful use of climate projection scenarios does not necessarily lead to gold-plating infrastructure solutions. In practical terms, there may not be an actual difference in the adaptation response between the scenarios for climate variables affecting a particular asset or set of assets. So, you’re better off being more risk-averse if little material difference exists in the climate adaptation response required.

The post Climate adaptation: principles to navigate uncertainty appeared first on Without Limits.

]]>The post What challenges do organisations face as they try to become ‘nature-positive’? appeared first on Without Limits.

]]>The post What challenges do organisations face as they try to become ‘nature-positive’? appeared first on Without Limits.

]]>The post New U.S. SEC climate-related disclosures rules appeared first on Without Limits.

]]>The post New U.S. SEC climate-related disclosures rules appeared first on Without Limits.

]]>The post How to make biodiversity work for your business appeared first on Without Limits.

]]>The post How to make biodiversity work for your business appeared first on Without Limits.

]]>